For the first time in its history, Spain has more than 47 million residents. According to the latest population data in Spain, this increase was due to the positive migratory balance of 209,097 people.

This population growth can also be mainly attributed to the increase of foreigners in Spain during the year 2019.

But what’s the biggest challenge for those moving to Spain? The answer is clear: the paperwork.

An immigration lawyer to sort out the Spanish bureaucracy

source:pxfuel.com

Spanish bureaucracy is tricky and slow. Sometimes fulfilling all the requirements needed to obtain a certain residence permit or even basic documents may be a real headache. That’s why many foreigners that are moving to Spain count with the help of an immigration lawyer like MySpanishResidency.

An immigration lawyer in Spain can help to fulfill all the paperwork before moving to the country.

As many of the formalities that need to be done in Spain require the presence of a representative, an immigration lawyer can serve this purpose by the power of attorney.

You will just need to write a letter of attorney. A power of attorney is a written authorization to represent or act on another’s behalf in private affairs, business, or some other legal matter.

After you have written the letter of attorney, your immigration lawyers will be entitled to act as your representatives in Spain.

What can a lawyer do for you?

source:pxfuel.com

- A lawyer can help you with the legal process of moving to Spain. Having someone to take care of all the bureaucracy is a great advantage. Having to move and prepare everything to leave your country of origin is a yet stressful project, so having someone in Spain that helps you from there is a very advisable idea in many cases.

- Visas and residency permits: The visa is a permit granted by the destination country through its consular representation or embassy in the country of origin of the person who is going to travel. There are different types of visas depending on the duration of the trip and the reason for it.

Any person who needs a visa, because it is required for the entry of a country, must go to the Embassy or Consulate of that country, where they will provide the necessary information.

Foreigners who wish to travel to Spain must be in possession of a visa unless they are nationals of countries that are not subject to the visa requirement for crossing external borders for stays in the Schengen Area of no more than three months (90 days) in a period of six months (180 days) from the first date of entry into the Schengen Area.

source:iscspain.com

In the case of citizens of the European Union, Norway, Iceland, Liechtenstein and Switzerland, as well as their spouses, common-law partners, ascendants and descendants, the applicable regulations are included in Royal Decree 240/2007, of 16 February, regarding the entry and stay in Spain of nationals of member states of the European Union and of other states that are parties to the Agreement on the European Economic Area. Therefore, the latter will not be required to obtain a visa to enter Spain, regardless of the reason for the trip, as long as they are traveling from within one of the aforementioned countries.

However, if you are a family member who is in your country of origin, who does not have a residence permit in Spain, and you intend to travel to our country, you will be required to obtain a visa depending on your nationality and the duration and reason for your trip.

source:rightcasa.com

This being so, an immigration lawyer can help you choose the right visa in Spain, and then applying for it the right way.

- Taxes in Spain: An immigration lawyer in Spain may as well take care of your taxes. A good tax advisor should provide you with guidance and assistance in the following areas:

- Non Resident Tax-INR (for those who own a property in Spain): Taxes paid by non-residents for non-rented properties.

The most common calculation of the taxable income is 1.1% of the cadastral value. The current tax rate for non-residents is 19% for residents of the EU/ EEA and 24% for others.

- ITP – buy/rent a property in Spain

The tax on property transfers and documented legal activities, also known as ITP/AJD, is an indirect tax paid to the Autonomous Community. A good tax advisor should know all the boundaries of this tax in order to minimize your tax burden.

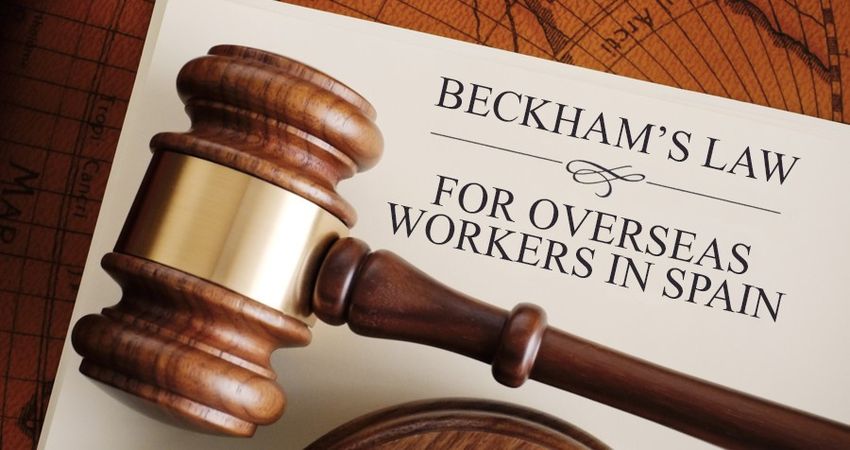

- Beckham Law (tax reduction for expats working in Spain):

The “Beckham Law” is a Spanish Tax Decree passed in June 2005. After the footballer David Beckham became one of the first foreigners to take advantage of it, the law was nicknamed as “Beckham Law”. The law is aimed at all foreign workers living in Spain, and it aims for a tax reduction for those expats that are working in Spain. Tax advisors like MySpanishResidency help many foreigners save on their taxes, taking advantage of the Beckham Law.

source:umuzee.com

- Personal Income Tax-IRPF:

The Personal Income Tax is a direct tax levied on the income of individuals. This gravamen upon wealth is calculated using a complex scale with different percentages. A tax advisor can help you minimize the tax you have to pay on IRPF.

- Accounting for Companies

- Accounting for Individuals

- Wealth Tax

Are there other legal services for expatriates in Spain?

source:arrabeintegra.es

Obviously, there are many reliable legal companies with quality lawyers within Spain, that offer many different legal services. You should seek for a reliable one offering information and legal advice for expats on a wide range of legal areas.

When looking for a lawyer, the important thing is that you have an option that allows you to solve your problems immediately. While choosing a law company in Spain, you should think about your time first. And when it comes to legal matters, making the most of it is important.

As we have seen, sorting the Spanish bureaucracy is often tricky and slow, and counting with the help of the appropriate advisor is crucial.