Businesses world is evolving at a rapid pace. The days when you have to carry cash to make purchases are long gone. Today, credit and debit card are all the rage. If you run a global business and go on frequent business trips then, you should get a business credit card for your business. If you are still not sure whether you should go for a business credit card or not, here are six reasons that will convince you to choose one.

Page Contents

1. Financial Flexibility

Businesses demand constant cash flow which is difficult to achieve in some cases. With a business credit card at your disposal, businesses can enjoy the financial flexibility and continuous cash flow facility. This means that you can easily make purchases without worrying about finances, which is liberty you always wished you had while doing business. What’s more, business credit cards are much easier to get as compared to loans and credit. This along with the benefits that come with business credit makes it a lucrative option for businesses.

source:supermoney.com

2. Differentiating Personal and Business Expenses

As a business, it is very important to track where the money is coming from and where it is going. Unfortunately, when you make purchases from a wide range of sources, it is very difficult. Imagine going on a business trip and your employee buying items for personal use. In such a case, differentiating business expenses from personal expenses becomes a daunting challenge but not so much if you have a business credit card. Some credit card providers also offer online tools that assist you in monitoring your expenses. Additionally, this makes record keeping a breeze.

source:deserve.com

3. Rewards, Cashbacks and Discounts

Probably the biggest advantage of having a business credit card is that you can earn reward points, avail discounts, and secure cashbacks while making purchases via a business credit card. Collect those reward points, and when you have enough, you can use it to make future purchases for free or at a fraction of a cost. Then there are discounts and cashback. By earning cash back on purchases and slashing your bill thanks to discounts offered on a business credit card, you can save a lot of money, which can be put to good use.

source:pengeportalen.com

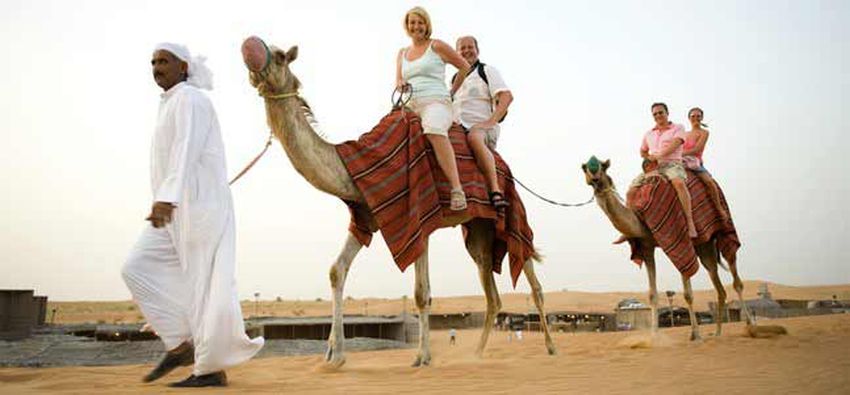

Some business credit card offers travel credits, which can be utilized to enjoy free flights and free hotel stays. One of the most popular tourist destinations in the world definitely is Dubai, and if you ever go there be sure to try out things like yachting, Dubai desert safari, camel riding, snorkeling, etc., and with a business credit card you will definitely get a discount on some of those attractions.

source:oasispalmdubai.com

4. Large Spending Limit

There are instances when you need a larger amount, but you cannot get it because you have already exhausted the limit of your withdrawal limit. Ever wished you had a larger spending limit? Business credit cards offer you a spending limit of $50,000 to $100,000, and that is many times more than any debit card or the amount of cash you might have in the bank. In short, business credit card fulfill your need for cash and help your business grow.

source:creditcards.com

5. Business Perks

A business credit card usually offers your business related perks, which is great. Let’s say your business cards offer reward points, you can redeem those reward points and enjoy business benefits such as free or low-cost shipping, discounts on business travel or cash back on business supplies to name just a few. There are credit cards that even offer rewards for advertising purchases. All you have to choose the right business credit card and you can enjoy a lot of extra perks that others don’t have access to. With a business credit card, you can save money while spending it and businesses cannot ask for anything better than that.

source:upgradedpoints.com

6. Keep Tabs On Employee Spending

When you are taking your employees with you on business trips, there is a high probability that they will splurge money on shopping or some other activities. Before you realize it, you might have exhausted your travel budget mid-way during your business trip. With a business credit card, you can keep a close eye on every single purchase made with a business credit card. This means that you can hold your employee accountable for the investments they make. Moreover, you can also set a spending limit for employees. This minimizes the risk of overspending and keeps your business travel expenses under control.

source:supermoney.com

Why would you choose a business credit card? Feel free to share it with us in the comments section below.