It is true that investing in cryptocurrency is one of the best ways to gain profits within a shorter duration. However, it happens only when you have the fundamental knowledge of crypto, how it works, when to buy and sell the crypto coins, what trading strategies to use, and when to stop investing. But, novices often ignore doing prior market research and get too many things wrong when it comes to cryptocurrency investments.

Page Contents

What Are The Aspects Where Cryptocurrency Novices Are Often Wrong

Check out the below-listed aspects where beginner crypto investors often make a mistake.

1. Spending a lot on brokerage fees

Source: cnbc.com

Beginners often register their account in any exchange they come across without checking the trading fees. Your trading profits might be reasonably reduced by hefty brokerage costs. Using a broker (exchange) with minimal trading fees, significant volume, and liquidity is crucial in this situation. In this manner, your trading profits will increase. You can visit bitcoinprime.software and create your crypto account to start investing in cryptocurrency.

2. No trading strategy

Novice traders frequently lack a trading strategy and are content to stay in a losing transaction for an extended period of time. Making trading errors can be avoided by having a trading plan before you invest in cryptocurrency. A strategy is required before engaging in any trade, and you must be aware of your entrance and exit strategy, initial investment amount, and maximum loss tolerance.

3. Purchasing cheap coins

Source: cnbctv18.com

The future direction of the currency is noticeable even before investing any money. Calculating the expected return on the investment is required even if the investment is not high risk. A cryptocurrency can emerge, but it can also be a scam.

You should avoid investing money in digital currency only because they are inexpensive. Several novice users are accustomed to believing that most alternative coins with low prices are just undervalued. This is due to the fact that several accounts of unexpected value increase already exist. However, this is untrue because not all crypto coins are profitable.

4. Avoiding Fundamental Analysis

Many newcomers choose a well-known cryptocurrency and begin trading in it. There is a probability that you will continue to make good money over time. A single significant loss would cause your portfolio to go into a negative zone for an extended period of time if the currency suddenly falls.

By conducting an essential examination of the coin you plan to trade, you can avoid this crypto trading error. Find out about the token economy, administration, and future prospects of the coin. Make a list of the tokens you want to trade, depending on these criteria. Keep in mind that every trader has a different situation; thus, you must tailor your technique.

5. Believing that everything they read is true

Source: chainbulletin.com

In the area of cryptocurrency, not all advice can work. Following tips and recommendations they read online from anonymous people is a standard error made by newbies. There is a tone of misleading hype and, in some cases, outright false advice about crypto trading on the internet. Even news websites frequently publish extremely hostile and alarming, often exaggerated headlines planned solely to get clicks, controversies, and FUD (fear, uncertainty, and doubt).

6. Absence of Stop Loss

The ultimate goal of risk management is to stop losses. When your projected deal fails, a stop loss might assist you in reducing your losses. No matter how certain you are that trade will succeed, failing to use a stop loss is one of the largest errors.

Several best cryptocurrency exchanges have this stop loss setting function, some of which also include a trailing stop loss setting. You must start using stop losses if you have never done so or have been skipping them in your trades. You can prevent the most common error made by cryptocurrency traders by using stop-loss orders on each trade you make.

7. Trading Using Pump and Dump Calls

Source: unsplash.com

Signals for purchasing and selling cryptocurrency are provided by groups on Telegram and Discord. But they rarely succeed. It would be better to skip such pump and dump methods, mainly if you are a novice.

Such organizations are not useful. The likelihood of such “Signals” working is next to none when thousands of users are responding to the same trade call. Additionally, the smart money has already entered or exited the market, and now the money of novice traders is on the line.

8. Revenge Trading

Losses in trading are unavoidable. Because they lack the stability to accept defeats, many users end up trading in retaliation. Such trading is really harmful to your trading since it is motivated by fear and frustration. These traders frequently try to engage in riskier trade in an effort to reduce losses. It is referred to as “revenge trading.”

After losing a trade, you need to exercise caution. Recognize that no trade has ever resulted in a 100% win. Even winning 40% of the time with the proper risk-reward ratio can keep your cryptocurrency portfolio in the black. So, avoid chasing losses at all.

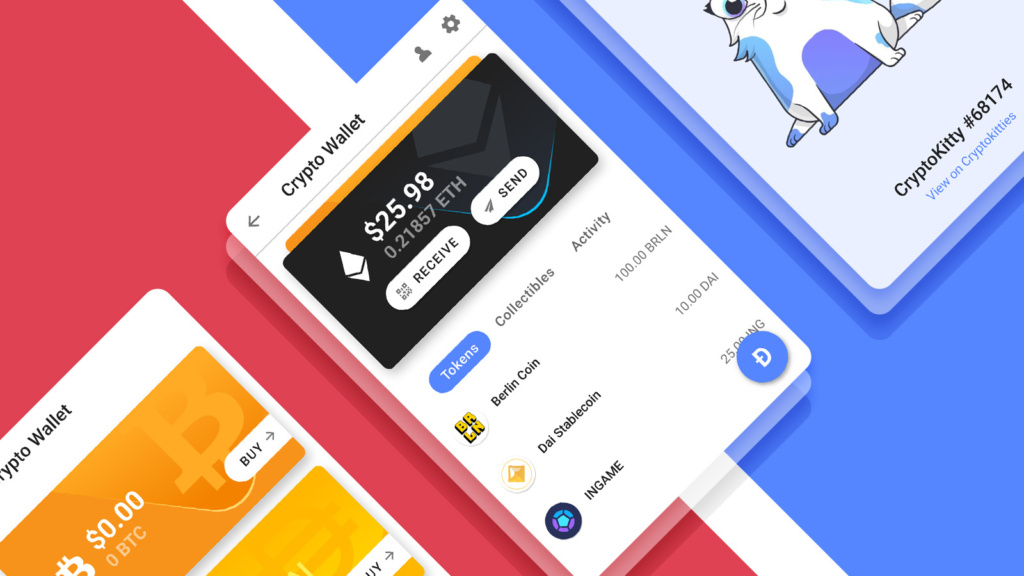

9. Submitting the wrong wallet address

Source: blogs.opera.com

Here is another aspect where beginners often make mistakes. Giving the incorrect wallet address makes it simple to transmit cryptocurrency to the wrong recipient without being able to get it back. Naturally, buying and selling cryptocurrencies is thrilling, but if you make a mistake, you risk losing your money. Before inputting the wallet address, always double-check it.

Scams exist in every field and can occasionally appear to be highly credible; many of them target inexperienced investors in the area of digital currencies. Make sure not to invest money in a site or open an account before doing your homework on it. In the area of cryptocurrencies, pyramid scams are also prevalent, so be wary of any website that demands that you find new investors in exchange for money.

Bottom Line

Fewer mistakes should be your primary goal with every trade, and you can master the art of trading in this way. Depending on your specific circumstances, you can adapt some of the aforementioned advice.