Bitcoin is the most talked-about subject in the financial industry. 2024 and 2024 have been fantastic for this cryptocurrency as it managed to not only break the record in value but breeze past it. As of March, Bitcoin is valued at around $50,000, which is quite a mesmerizing number.

The recent spike attracted many new traders to the network as they are seeking to make a profit and become overnight millionaires. After all, Bitcoin has provided that too many people from all around the world. We decided to help these new traders get more familiar with this world by naming and explaining several Bitcoin terms that they should be aware of. The more familiar they are with this cryptocurrency, the higher their chances of success are. Let’s check them out.

Page Contents

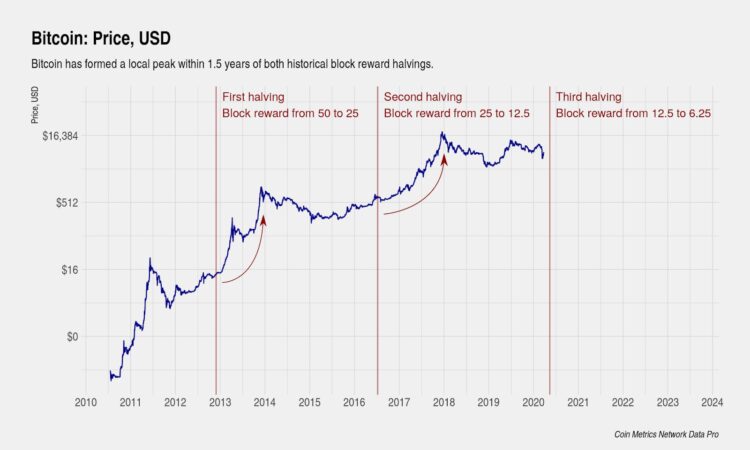

1. Halving

Source: investopedia.com

Halving is an event that takes place when 210,000 Bitcoins are mined. During this event, the production of Bitcoins is cut in half and it becomes extremely hard to mine them. These events control the flow of Bitcoins in the network and make sure that the market is not overflown with them. There have been 3 halving events so far – 2013, 2016, and 2024. All of them led to a spike in Bitcoin’s value shortly after they ended.

2. Trading Sites

Trading sites are the platforms that people visit to buy or sell Bitcoins. What’s interesting about these sites is that they are much more than just marketplaces. We’ll take bitcoinstorm.io, one of the most reputable trading sites as an example.

Bitcoin uses the latest AI systems to collect all the data about Bitcoin on the market. After the data is collected, the system analyzes it and based on that information, makes accurate predictions on how will Bitcoin fluctuate in the near future. In doing so, traders will know when is the best time to sell their Bitcoins and maximize their profits. As you may know, Bitcoin is a highly volatile cryptocurrency, whose value changes daily, and knowing how the price will fluctuate is a very powerful asset to have.

3. Blockchain

Source: investitor.me

Blockchain is the technology that powers Bitcoin. This is one of the most commonly used terms with this cryptocurrency. A blockchain is a unique type of database that stores all of the transactions made with Bitcoin. Thanks to this database, there is no need to have a central regulatory body that will store this type of information, hence allowing Bitcoin to be decentralized and self-sustainable.

One part of the blockchain is a block. A block is a single transaction in that database. Blocks are the key to earning Bitcoins. For every block that users record and verify, they earn Bitcoins. This process is known as mining.

4. Cryptography

One of the biggest advantages that Bitcoin holds over FIAT currencies is the fact that it provides its users with a certain level of anonymity, thus it increases their overall online security. This advantage is provided by a method called cryptography or also known as cryptology. Cryptology uses codes as a means of communication and in doing so, it masks the true information that is sent and received, thus keeping the details a secret. Mind you, this method does grant you full anonymity.

5. Satoshi

Source: cointelegraph.com

There are two definitions of this term. First off, Satoshi is the creator of Bitcoin. The interesting thing about this individual is that to this day, nobody knows his true identity. Satoshi Nakamoto is just a pseudonym. We don’t know the person’s age, nationality, gender, or whether he is even alive today. For all we know, Satoshi could be a group of people, as well.

The second use of this term is used as a subunit of Bitcoin. One Satoshi equals 1⁄100000000 Bitcoins. This subunit was named after the creator of Bitcoin.

6. Hash rate

This is a term encountered in mining. Hash is the output of a hash function, as with Bitcoin, the hash rate is the speed at which a computer calculates the operation in Bitcoin code. The higher the hash rate, the higher your chance of mining finding the next block, and receiving the prize. Hash rate is calculated in hashes per second (h/s). Some of the common terms use mega, giga, and terra, depending on the number of hashes.

So, the hash rate is the number of calculations that the hardware can perform in one second. Hash rate is a key aspect of the hardware. The higher it is, the more likely you are to be able to solve complex mathematical calculations and get a BTC reward.

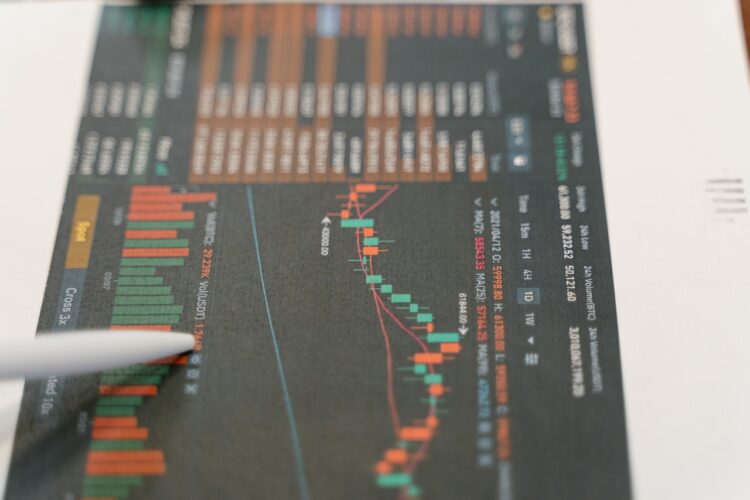

7. Volatility

Source: pexels.com

You can almost always hear this term with cryptocurrencies and it means instability. It is the range and speed of stock market movements. In other words, it is volatility that tells us whether it is the right time to enter or not. If the volatility is higher, the chances of earning are less and vice versa. This is one of the main factors why some give up investing in cryptocurrencies, and on the other hand, it is the reason why many approaches. There is no profit without risk, and a little excitement in business comes in handy, doesn’t it?

8. Liquidity

The term liquidity is an effective measurement of the ability to buy or sell a particular asset at current fair market value. Although bitcoin and other cryptocurrencies are digital money, fiat currencies still have a higher level of liquidity.

9. Digital wallet

Source: paymentsjournal.com

Every money is kept in a wallet, including cryptocurrencies, but in digital, of course. If you engage in trading or mining, this is something you will not be able to do without. The job of a digital wallet is to keep your virtual money safe. You can achieve this in two ways, hot and cold wallet. Although there are probably more of those who use a hot wallet for financial and practical reasons because a smartphone and internet connection is enough for it, hardware or cold wallet is a much safer option because it better protects against hacker attacks. It is up to you to decide which one suits you best. Basically, once your money disappears from your account, don’t expect to track him down.