With a long and available list of brokerage options offering $0 stock and ETF trades, getting to know which stockbroker is best suited for your needs can be one of the most challenging decisions for an investor.

Since the race to zero stock commissions is all but over, other investment offerings such as customer service, availability of tools, and attractive trading features take a front seat.

Many persons who are citizens of both the United States and Canada can enjoy the benefits of dual citizenship. Apart from other benefits, it is the financial impact that allows them to earn significantly more money than the non-citizens of these countries, especially when investing in the stock market.

However, as an investor, you should be aware before selecting a broker in the US or Canada as trading tools and platforms vary significantly between the two countries. American brokers have an edge in fees and mobile app availability, but Canadian brokerages also work hard and stand out by the exemplary trading experience they provide to the client.

Your online broker acts as your intermediary connection to the stock market. That said, currently, very few US brokers support non-US citizens due to many complexities.

So if you hold dual citizenship and want to buy stock overseas, here is an unbiased and thorough review of the five best brokerage houses to select the right online discount broker.

Page Contents

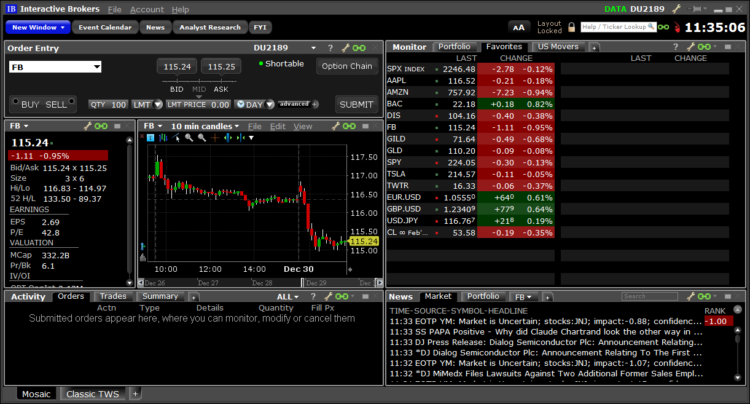

1. Interactive Brokers (best for professionals)

img source: interactivebrokers.eu

For casual, institutional, and professional investors, the user-friendly best under the sun trading platform, Trader Workstation, and rock bottom margin rates have made Interactive Brokers or IBKR, the leader of the pack once more in 2024.

IBKR is known best for the 135 market centers in 33 countries around the globe it allows investors to trade-in. Additionally, professionals can gain by taking advantage of the industry discounts and low margin rates across all platforms.

2. Qtrade (best for research)

img source: cointocapital.com

Great balance of platforms, multiple account types over a range of markets, and enjoys a rating of 4.8/5 from Milliondollarjourney.com. This has made Qtrade, formerly known as Credential Direct, a popular cost-effective online broker with both young and frequent investors. Founded in 2000, this Canadian stockbroker, not to be confused with Questrade, is regulated by a top-tier organization that covers both the Canadian and US markets.

This is because its regular fee of CAD 8.75 drops down to CAD 6.95 for those making over 150 trades in any quarter/ or having CAD 500k minimum account balance and for investors in the 18-30 age group. Users can also trade with over a hundred ETFs for free as well as in mutual funds. The one glaring drawback with Qtrade is the CAD 25 fee they charge for accounts lesser than CAD 25,000.

Qtrade has attained a popularity for its advanced portfolio analysis, which allows the investor to test different scenarios for investment by getting a second opinion across five investment dimensions.

3. eToro (best for cryptocurrencies)

img source: traderscult.com

Founded in 2007, eToro an Israeli fintech company is an easy winner when it comes to safe brokering in forex, CFDs, and popular cryptocurrencies. They have an easy-to-use platform which is excellent for social copy trading over 2300 instruments. This makes it a hit with retail traders, despite a slightly higher variable spread as compared to others in the industry.

eToro is also a fantastic tool for an introduction to the money market for those who have no clue about the trading experience. You can click here to read this eToro review and learn more about its social trading features.

Additionally, eToro offers a $0 commission for US stock trading, which is not available to US investors and also supports fractional shares. Also, their social trading network is an exciting feature that is unavailable with most other online brokers. On the negative side eToro charges high non-trading fees, withdrawals are slow and USD is the only currency you can hold in cash.

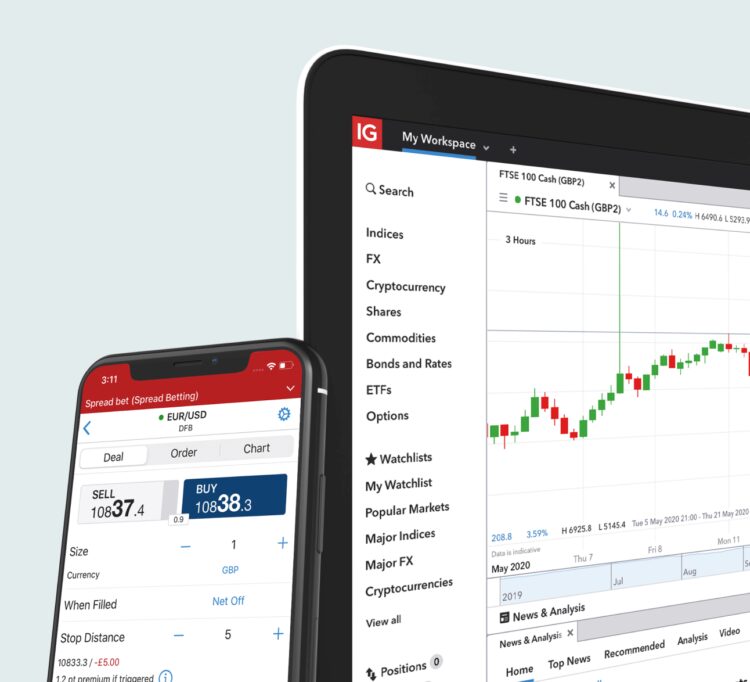

4. IG (best for forex and CFD trading)

img source: ig.com

Trusted across the world, IG is the top broker when it comes to competitive pricing, forex trading in 104 currency pairs, and a wide range of tradeable products. With an overall Trust Score of 99/99 IG is considered low-risk and has not shied away from the US market, as most online fx brokers do, to keep its commitment of being a global entity.

Globally IG is best for anyone who wants to trade in CFDs, except for US citizens though only for forex. Low spread costs, excellent customer service, good research, and the best educational tools in the industry make IG a broker to contend within the online brokerage market.

You can trade on IG on their own web trading platform or through their third-party software Meta Trader 4. Both platforms provide advanced alerts and notification settings.

5. CMC Markets (best for beginners)

img source: genuineforexbroker.com

CMC Markets was established in 1989 and is known for its terrific user experience and a massive number of almost 10,000 trading instruments and a fantastic mobile app. CMC Markets pricing is better than the industry average and is available to all customers and account types.

CMC Markets offers the following accounts, apart from others, to both corporate and individual clients:

- 300+ currency pairs

- 30+ treasuries and bonds

- 9500+ instruments for speculation on forex, gold and equities.

- 9000+ ETFs and shares.

- 90+ commodities

- US and Canadian Share CFD commissions from $8.

- Supports Meta Trader 4

While CMC Markets is good for new entrants and active CFD traders, it does not accept US clients, offers no social trading, and spread betting is limited to UK residents.

Remember, when you want to choose an online broker, it is you who is the boss as you only have to make the investment decisions. The Canadian brokerage houses above can help you get started, as each has a mix of different assets to allow you to select one with the least risk. Having said that, all these brokers in spite of their good record, have plenty of room for improvement.