You know the importance of growing your savings from the early days of your marriage. Money is always going to be tight. Could a day trading side hustle help? Should you trade cryptocurrency or stock? Do you have to choose? Could you trade both?

Page Contents

Stocks vs Crypto – The Basics

Source: pexels.com

Individuals might be tempted by seemingly irresistible opportunities. When you work with any other person your chances of making bad trading decisions are reduced. This is especially the case if you work closely with your partner who understands your propensity to jump in without research.

When you buy stocks, you hold a financial instrument that is backed by the company’s assets. You own a small share of the company. Your stock’s value depends largely on how traders see the company’s future performance.

When you buy crypto, you hold a token whose value is flexible. It is worth whatever the market decides it is worth.

Your token has no intrinsic worth. Its value will increase if traders think it will go up and decrease if they think it will go down.

You have done your reading, you understand how trading works, you have subscribed to a premium advice service –

Are you ready to risk your savings? No.

You learn by making mistakes, mistakes with your savings will affect your wealth in years ahead.

How do you make painless trading mistakes? You open a free virtual trading account with your chosen broker. You invest your virtual money as though it was real cash, following your recommendations by your own research. When most of your virtual trades are coming in as positive, then, and only then should you consider switching to real-life money. You might have some loss-making trades. Be prepared. It happens to everyone.

Price Movements

Stock price movements happen when traders see news that will affect the company’s prospects. This is usually company-related financial news. However, it could be more general news relating to the economy or politics.

Crypto price movements happen at random intervals. They depend on traders’ emotional perceptions of where the price will go. Emotions are illogical, so many crypto price spikes and crashes are caused by mass hysteria among traders. There might be a political base such as when China banned all crypto activity in 2024, but traders can often find no rationale for the big crypto price changes you see in your daily news feed.

Past performance really is no guide to future projections with either stocks or cryptocurrencies, but this is doubly true for crypto price movements. Even a crystal ball would not help you much.

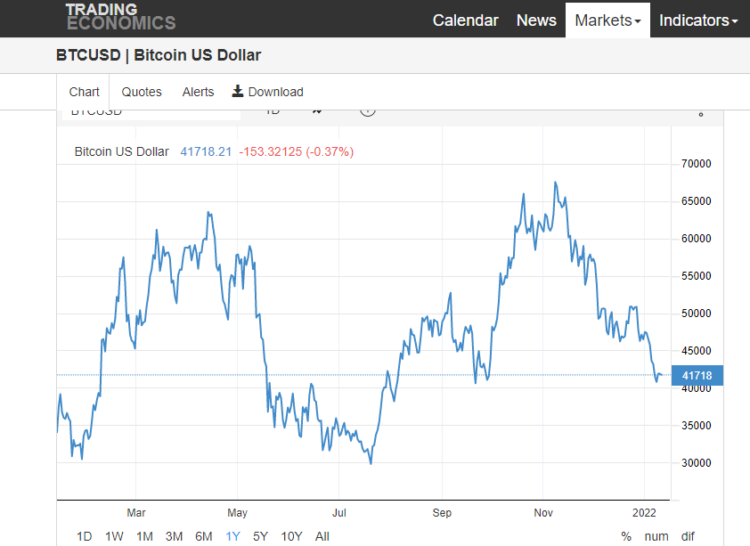

Source: tradingeconomics.com

The lifetime Bitcoin value chart above lets you see the extent of the price crashes over the past 12 years. Yes, the trend has been upwards, but it has been a rough ride. The flash crashes occurred when the market panicked. There is little logic behind them. The next crash will be similarly unpredictable; illogical and caused by hysteria among traders.

The chart above shows Bitcoin prices, but most other cryptocurrencies rise and fall when Bitcoin does.

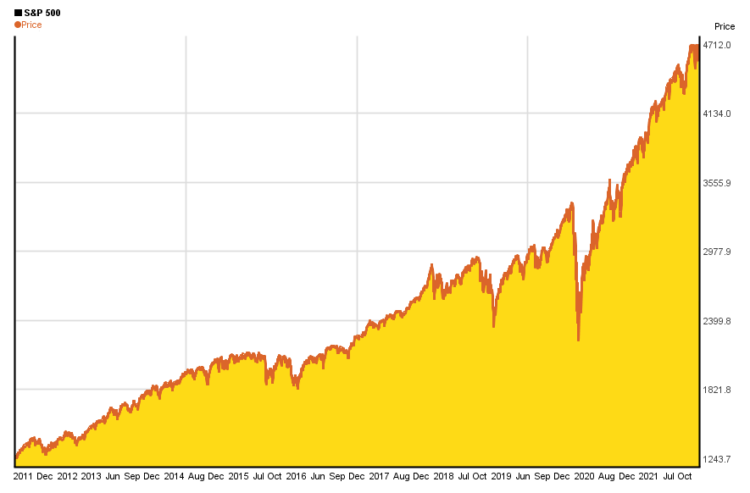

Source: 5yearcharts.com

Stock prices fluctuate, but nothing like crypto. The S&P 500 10-year chart above shows a few crashes, notably 2008 and 2024, but these are clearly blips on the upward trend of the chart, and these crashes are easily explained by the sub-prime crash and Covid-19 respectively.

Combining Crypto AND Stock Investing

Source: pexels.com

If you want to limit your exposure to crypto price crashes, you need to limit the amount of crypto in your portfolio.

This will mean any crypto-boom is not going to sky-rocket your savings total. However, your investments will only suffer slightly when the next crypto-crash occurs.

Different Ways of Trading

Source: pexels.com

Trading is not the same as investing. Investors buy and hold stocks or crypto for the long haul. They buy in the anticipation of price growth over the years. They might also buy stocks that pay dividends.

Traders buy and sell stocks or cryptocurrencies and usually sell on the same day. They look for short-term price movements.

Contracts for Differences (CFDs)

Source: pexels.com

When you take out an asset CFD, you predict whether the price of the asset (crypto, currency pair, stock, or index) will rise or fall. You never own the asset. If your prediction is wrong, you lose your deposit. If your prediction is correct, you get your deposit back plus profit.

CFDs are particularly useful for crypto traders because they also allow you to profit if the cryptocurrency is falling in value, as long as you predicted the fall. If you were to invest in crypto by buying coins on an exchange, you would lose money if the price fell.

CFD crypto trading is risky, so look for a platform like easymarkets.com that helps you to manage your risks and provides resources for learning about trading.

Many platforms offer a free virtual trading facility. You should use this until you can accurately predict crypto movements consistently.

You should get automatic stop-loss positions where your CFD is closed if it falls below a value you set. The best platform will take ask how much you are prepared to lose on a trade and take that amount as your deposit. If your trade goes bad, you only lose the deposit.

The Bottom Line

Trading CFDs lets you start trading with less capital than if you were to buy stocks or crypto from a broker or exchange.

Trading is risky. Notice the warning on any trading site about the percentage of traders that lose money using that platform. That could be you unless you put time and effort into research and practice trading with a virtual account before using your credit card for real.

Even the best traders lose on some trades, so you are always going to lose money some of the time. When you have spent 6 months researching and learning how to trade, you still won’t know everything, so keep your trades small and affordable.