The first time for any experience is exciting and daunting at the same time. The same is true for leaving your parents’ home and into a place of your own. While you have the freedom to make your own decisions and live independently, you need to understand some essential details, such as the amount of money you’ll need to save for rent and utilities, the rental application process, and the paperwork you’ll need for the entire process. So before you feel overwhelmed with the enormity of the task ahead of you, we’re here to help you with 10 important things you need to know as a first-time renter.

Page Contents

1. Set a budget

Source: pexels.com

Renting a room involves costs other than rent. So, before you start looking up a rental room, you need to set a budget that covers expected and unexpected expenses. That way, you’re not flooded with costs that you never knew existed or saw coming.

It’s advisable to spend around 30 percent of your gross income on rent. An excellent way to budget your expenses is to follow the 50/30/20 rule, where you spend 50 percent of your salary (after taxes) on essentials, 30 percent on things you desire, and the remaining 20 percent on savings.

Finally, consider upfront expenses and long-term expenses when budgeting. For instance, application fees, first and last month’s rent, security deposit, and maybe a pet deposit comprise upfront expenses that you’ll need to set aside funds for. If you have the rent saved up for a few months, that should do the trick. As far as long-term expenses go, it involves frequently-purchased things and utilities that include but are not limited to electricity, internet and cable, gas, water, sewer and trash, cell phone services, groceries, and clothes.

2. Figure out your (home) needs

Regardless of where you live, you must have created an image in your mind of the ideal place you see yourself living in. And we’re sure that the perfect place includes the things you’ll need to live well versus those that you desire. They’re two very different things, so don’t combine them. As an adult, you know which is more critical, so lower your expectations so that there’s no room for disappointment.

For example, if you have a car, you’ll need to find a place that has a decent parking space. And if you don’t have a car, it’s crucial to find an area with easy access to public transit facilities. These are basics you can’t do without. On the other hand, if you wish your rental had a swanky gym or a swimming pool, these are things that you could do without.

3. Know your rights as a tenant

img source: rentezy.com.au

As a first-time tenant, it’s imperative to be well-versed with the tenant laws specific to your state. Otherwise, it’s easy to be taken advantage of and not take proper action when the need arises. So, read up your state tenant-landlord laws well, especially the parts which throw light on the situations where the security deposit might be withheld, those that can lead to eviction, the days of notice that are required when a tenant decides to leave, and so on.

4. Check with the landlord about included utilities

Some landlords include utilities in their rental properties while others don’t. So, when you meet your landlord, ask them what utilities come with your rental room and what you need to provide for yourself. In addition, check with them whether the utilities they provide need to be paid with the rent or separately to avoid confusion.

5. Know the application process

img source: thebalancecareers.com

Since you’re renting for the first time, you may not know what the rental application process entails. Do a little digging on the internet and find out the procedure. All you have to do is fill out an application form, pay an application fee, and allow your landlord to perform a background and credit check to determine your eligibility.

The process is pretty quick too. In fact, you may get to know whether you’ve been shortlisted or rejected in less than two days, and sometimes it’s not even a day!

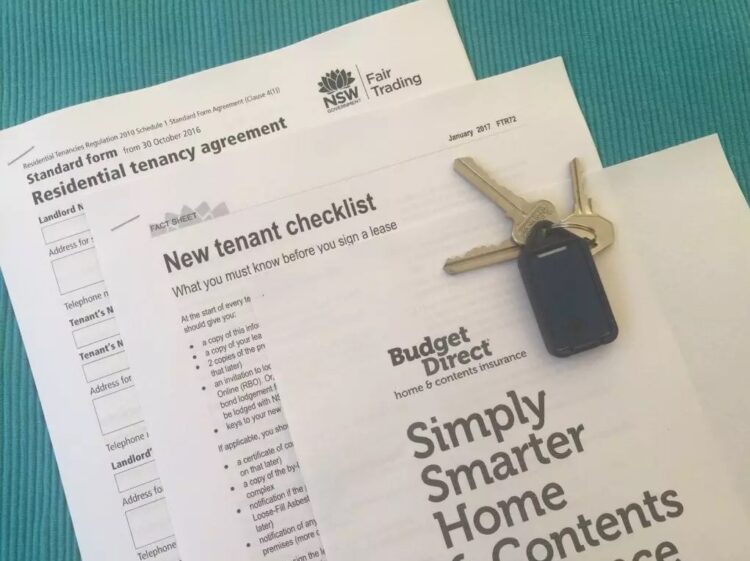

6. Read and understand the lease terms

Once you finalize the rental space, you need to sign the lease agreement. It’s a contract highlighting the rights and responsibilities of both the landlord and the tenant. As thrilling as it may be to sign the lease right away, it’s advisable to give it a thorough read before you do so.

Also, it’s likely that you might come across clauses that you don’t follow or something that you disagree with. If so, have a candid discussion with your landlord and get them clarified. Finally, if you need something added as per an earlier discussion, make sure the landlord adds it to the lease to avoid future misunderstandings.

7. Purchase renters insurance

img source: trevorhickmaninsurance.com

Renters insurance is something tenants know about but aren’t sure if they require it or afford it. While it’s not mandated by law, some landlords may include it as part of the lease agreement. As a first-time renter, you may be clueless about what it is, so let us share some information here.

Renters insurance safeguards your belongings in case of theft, fire, or natural calamities. It not only includes your possessions but also covers property, personal liability in case you or someone you know gets hurt on the property premises, and temporary housing, should your rental space be unlivable due to damage. Since the monthly premium is less than $15, you shouldn’t think twice before buying it.

8. See if you need a roommate

Depending on the city you’re moving to and the standard of living involved, ask yourself if you can afford the costs of living alone. If you’re in doubt, consider getting a roommate through Cirtru because that way, you end up saving money, now that your expenses are split in half.

Also, while the company may do you good, remember that a good friend or coworker doesn’t necessarily imply a good roommate. Whoever you choose to live, known or unknown, have them included in the lease. An even better way to ensure that the living situation’s devoid of complications is to have an honest discussion about expectations. Note them down so that both of you know what your responsibilities, monetary and otherwise, and boundaries are.

9. Check if you need a co-signer

img source: bankrate.com

Being a first-time renter, it makes sense to get hold of a co-signer or guarantor for your rental room. If the landlord’s caught between a rock and a hard place about your ability to pay the monthly rent timely, this will allay their fears.

In instances where you are unable to pay your rent, your co-signer becomes your financial support and ensures that your payments are up-to-date. If you believe that there’s no need for a co-signer, reach out to employers, friends, and anyone else who can vouch for your character and have them share a reference letter with you. If your landlord has a problem with your lack of rental history, these letters will validate your nature and ability to be a perfect tenant.

10. Do a walk-through with your landlord

When you’re ready to move into your rental room, take a tour of the space with your landlord and note any damage or dirt you see in any corner of the place. Look for holes in walls, mold, vermin, and so on. Also, check to see if the water’s running and the lights are working, not to mention the condition of the cabinets, closets, and appliances, if any. Your landlord might even hand you a sheet on which you can mark or tick off the issues with the rental space.

Once done, have your landlord fix the issues that can be fixed. If you choose not to go ahead with the inspection, remember any damage that your landlord comes across when you’re about to move out, will have to be paid from your security deposit.

Feeling more confident about getting out there and finding yourself your dream rental space? We believe you are! While the chance to live life on your own terms is both liberating and scary, know that if you separate your needs from your wants and focus on what you have, you’ll be in a much better place to live a life you’ve only dreamed of. Focusing on what’s essential will help you remain within your budget and live comfortably!