Shopify is an online commerce platform for business owners to create an online store and sell their products. It is a great way for business owners to set up shop easily, quickly, and cost-effectively, as Shopify handles hosting, payments, product management, and more. However, there are fees associated with using Shopify that must be taken into consideration when managing your overall taxes and accounting.

Page Contents

Overview of Shopify Fees

Source: launchtip.com

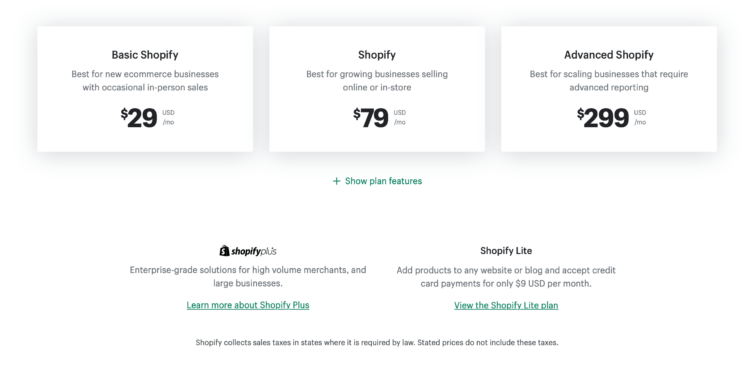

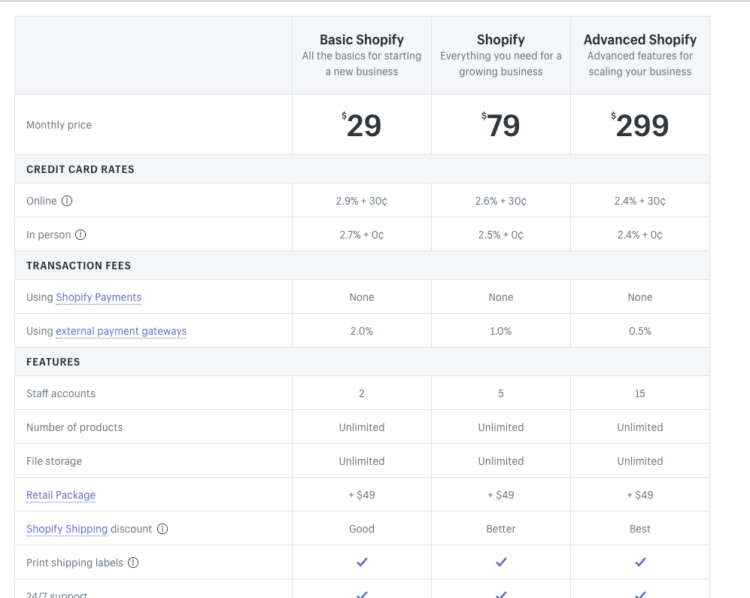

The first thing to note is that Shopify charges both a transaction fee (TTF) and a subscription fee. The transaction charge applies to each sale you make and is based on the total value of the order (including taxes and shipping). While this charge can vary based on the payment gateway you use, it typically ranges from 2% to 2.9%. The subscription fee covers access to the platform and all its features, such as customer service, product management tools, etc., and ranges from $29/month USD for basic accounts, up to over $300/month USD for advanced accounts.

At smaller scales, these costs may seem minor but quickly become significant as your business grows. As a seller, it’s important to track expenses associated with your account closely, including Shopify seller accounting.

To do so you should create accounting categories for each type of cost – for example, ‘transaction fees’ or ‘subscription fees’ – then set up designated budgets for each one each month or quarter. This will help you see exactly where your money is going in comparison to what it should be spending on fees associated with running an online store.

Strategies to Manage Shopify Fees

Source: prisync.com

Managing your Shopify fees can quickly become a headache, especially if you’re dealing with a lot of business transactions. To ensure that you don’t go over budget, it’s important to have a strategy in place to manage your fees. Here are some tips to help manage your expenses:

• Utilize automation tools

By automating the process of generating invoices, tax calculations, and statements for customers, you can partially or fully eliminate manual data entry tasks that can be quite costly to execute. Automation tools also help save time, giving you more opportunities to focus your energy on other aspects of the business.

• Utilize third-party payment gateway providers

You may be charged extra charges by Shopify if you use certain payment gateways through their platform. To work around this issue and avoid additional costs, you can look into third-party payment gateways, such as PayPal or Stripe, which offer more cost-efficient options than those provided by Shopify on their platform.

• Try barter systems

Many businesses have reported success offering barter systems in exchange for products/services from other businesses. This is an effective way to cut costs since there are no monetary exchanges involved and businesses can benefit from each other’s resources and services without having to spend any extra money on fees.

• Negotiate with suppliers

It may be worth negotiating directly with suppliers for better pricing if you have the necessary resources and knowledge about how their services work. This way, you don’t have to rely on intermediaries and will likely be able to reduce costs associated with fees charged by middleman services like Shopify and credit processing companies.

• Streamline operations

You also want to aim at streamlining every aspect of your business operations as much as possible. Focus on improving efficiency wherever possible so that fewer staff members are required for completing work which will result in lower operational costs thereby reducing fees in the long term.

Utilizing Shopify Fee Calculators

Source: liquify.design

Utilizing Shopify fee calculators can be an effective way to help manage the costs associated with setting up your business. Shopify provides users with various convenient and easy-to-use platforms to assist in calculating fees involved with a variety of services. Through these calculators, business owners are able to see the amount of money they will likely spend on setup costs, and even view an estimate of potential revenue from sales.

With this information, it is much easier for business owners to craft a budget and determine how much money needs to be allocated toward activities related to setting up their stores and managing daily operations.

Furthermore, some calculators allow users to adjust parameters such as the cost of goods or sales price in order to determine the best pricing options for different products. This insight can help entrepreneurs make more informed decisions on structuring pricing for products and services within their stores.

Optimizing Plan

Hand writing Time to Plan concept with blue marker on transparent wipe board.

The key to reducing accounting charges associated with using Shopify is understanding the different tiers and plans available, as well as potential fees that may vary based on usage. Knowing how to optimize each plan can help keep your costs within budget. Here are some strategies you can use to manage your Shopify fees:

- Evaluate your current plan – Regularly reviewing your current pricing plan can help you determine whether you could benefit from higher-tiered plans that offer additional features at a lower cost per month.

- Watch for promotions – If you don’t need the features of a more expensive plan, consider taking advantage of time-limited promotions and discounts when they become available.

- Track transaction fees – Reviewing your transaction records from month to month will help you identify any changes in processing or transaction fees, helping you determine if any adjustments need to be made in order to stay on budget.

- Utilize existing payment options – Reviewing the different payment options available when making purchases can save on transaction costs associated with e-commerce payments through Shopify. Consider setting up subscriptions for recurring purchases whenever possible.

Conclusion

In conclusion, Shopify fees can have a major impact on your accounting. It is important to understand the different types of fees, what they are used for, and the strategies you can use to manage the costs associated with them.

Through careful analysis of your business needs and evaluating potential cost savings through Shopify features, you can effectively reduce overall costs associated with the platform. Additionally, taking advantage of promotional discounts for payment options and payment plan flexibility can help reduce your overall costs by offering more cost-effective solutions for running your store.

Furthermore, integrating other third-party apps into Shopify can help streamline processes and reduce transaction fees. Ultimately, careful planning can help ensure that accounting for Shopify fees won’t overshadow your potential profits.