Buying a house is not the same as purchasing bread or milk. A buyer has to take some important points into consideration before the alternatives are considered and the buyer finalizes his move.

Why do buyers have to be careful? Why do they need to take their time before signing the agreement? If you are living in the UK, the price of property would not be on the lower side. Most people take a considerable time span before they purchase a piece of property in the UK. When you are using your hard-earned money, it is recommended to avoid haste and think in an intelligent manner.

source:fool.com

Page Contents

The stamp duty and first home leverage

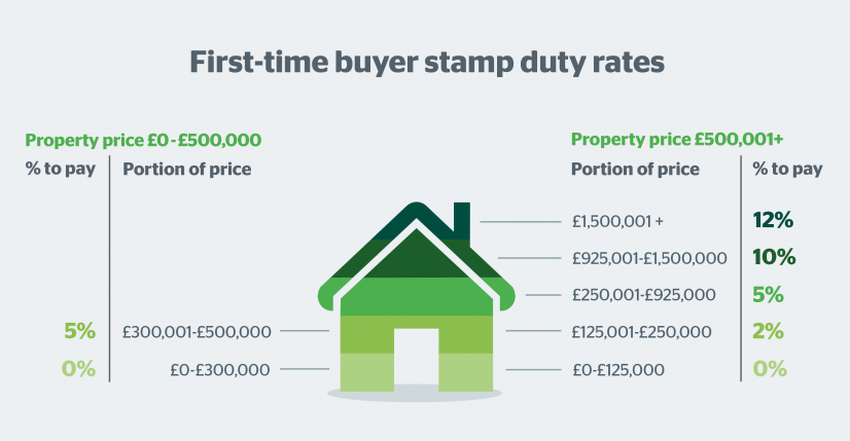

Stamp duty (rate) is the additional amount which house owners have to pay to the government when they are purchasing a house. In the UK, a certain leverage is offered to people who are buying their first home.

source:proptiger.com

- If you are purchasing your first house in the UK, the price of the house would play an important role because an exemption condition is applied. Let us go through an example to gain more understanding. If you have purchased a house in the UK with a price of £125,000, no rate would be applied on it. This is because, in accordance with the regulations applied in the UK, duties are not applied on a property if the price is below. The duty starts getting applied when the price goes above this value. If the price is below this figure, no rate will be applied.

- Once the house price goes above £125,000, the rate would surely depend on the price of the house. In accordance with the benchmarks set of UK government, there are different slabs highlighting the rate of stamp rate. For instance, if the price is between £125,000 and £ 250,000, a stamp rate of 2% would be applied on the amount that exceeds £125,000. It is important for users to be aware of these figures and stamp rate Most users who are buying property in the UK do not have any idea of these benchmarks. Thus, when they have to pay the stamp duty, it is an unexpected thing for them. They do not know anything about the rates and the stamp duty deduction figure.

Core plus points of the stamp duty calculator

If you are using a stamp duty calculator, you can expect the following benefits to come your way.

source:which.co.uk

1. Avoiding Complex Calculations

A lot of people do not have advanced mathematics knowledge. For them, calculating percentages is nothing less than a nightmare. Using a high standard calculator is actually the best way to perform these calculations. To calculate the stamp duty, there are few factors you need to take into account. The price of the property is important and the stamp duty amount depends on it. For instance, whether the property value is £ 200,000 or £ 250,000, the stamp duty would be charged at 2%. However, the amount to be deducted would increase or decrease with the amount.

2. No apprehensions about accuracy issues

Irrespective of the purpose for which calculations are being done, there is no room for error when it comes to accuracy. It is a common perception that if the stamp duty calculator is not dependable, the correct amount would not be determined. This does not mean that you should go through the stress of manual calculations.

- Calculators.tech stamp rate calculator is used online and helps in dealing with accuracy problems. As the tool is online, you can use it from more than one device without any issues. The features are simple and a lot of inputs do not have to be entered. When you enter the price of the property, the stamp rate would be calculated automatically. This tool does not require users to fill out detailed forms and spend a lot of time. You can get done with the calculation process in a short while.

3. Major cut down of the effort

Most people do not have strong enough mathematics knowledge to perform calculations. Even if they have, it takes a lot of effort to perform calculations without the use of a technological tool. When you have the option of using one of these tools, there is no point in putting so much effort and doing the calculations manually.

- The stamp duty calculator assists in saving energy and using it for a better purpose. If you use a tool, you would not have to go through the calculations, check the mistakes and perform other related tasks. A quality tool would perform end to end calculations. As a user, you would not have to go through any tasks.

- Users can save the effort for something more productive rather than performing calculations manually. Using the stamp duty calculator eliminates all the doubts that your calculations would have errors. Once the results have been produced by the tool, you can be absolutely sure that no errors have been made.

Conclusion

source:newindianexpress.com

Buying a property is obviously a very important decision for any individual. If you are buying a property in the UK, you should be well aware of the application of stamp duty. At times, users do not determine the stamp duty before making a purchase. When the rate is applied, they fail to figure out the calculation logic. Before you purchase a property, make sure that you know about the percentage being applied. This percentage depends on the price of the property and whether an individual is purchasing his first home or not.

As a user, you need to be aware of the regulations of buying a home in the UK. The application of rate does happen and it depends on multiple factors. The key problem is that a lot of people do not know about it. They figure out the payment after the purchase has been made. Using the stamp duty calculator, you can determine the correct sum for the rate. Using a calculator is an easy option as you do not have to sit for long time slots and complete the calculations. This tool determines the correct figure which the user is required to pay.