If you’re looking at buying a home for the first time, as one of the biggest purchases you’ll make in your lifetime, it’s important to choose one that you’ll be able to afford. And, setting the budget before you begin searching for the right house is a must – you don’t want to waste precious time touring places that cost more than you can afford. That dream home isn’t your dream home if it’s way out of your price range.

According to a recent report by CoreLogic, many buyers feel that the higher prices for homes these days are forcing them to spend more than they’d expect, with as much as a third of buyers admitting they also put down a higher down payment. That could put at least some of those buyers at risk of big financial problems later.

Thankfully, there are plenty of ways to ensure you begin your house hunting on the right track. Read on to discover how to search for a quality house you can afford without having to worry that it’s out of your reach.

Page Contents

Use a Home Affordability Calculator

source:pinterest.com

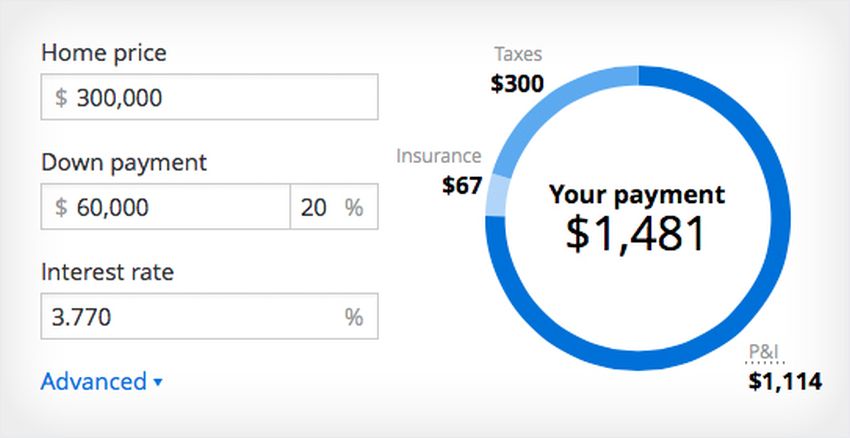

According to Redfin, using a home affordability calculator is the easiest way to start searching for a house. You’ll enter total household income, down payment, monthly bills and the city you plan to purchase in, and it will tell you to determine a target price. By doing this, you can make sure you find a house you’ll love and most importantly, feasible according to your financial needs.

Do Your Own Calculations

source:urban.org

You can also calculate a reasonable range for purchasing a home manually. You’ll need to multiply your total annual income by three to figure out the low end of the range, and also by four to determine the higher end of the range. For example, if you make $100,000 per year, you’ll want to search for homes that are priced anywhere from $300,000 to $400,000.

Dig a bit further to determine what you’d feel comfortable paying monthly by taking your monthly income after taxes and subtracting all regular debt payments. When you come up with that figure you’ll multiply by .25 – a good rule of thumb for ensuring that the home will be affordable while still being able to balance other priorities such as retirement savings and vacations.

Most financial experts agree that homebuyers should spend no more than 28 percent of their gross monthly income on housing expenses and no more than 36 percent on total debt. This said, buying a new house is a major commitment, and it might not be a bad idea to consider a financial advisor.

Don’t Forget About Your Credit Score

source:urban.org

The higher your credit score, the lower your interest rate, so that’s also something you need to think about before determining how much house you can afford. A higher interest rate obviously means a higher monthly mortgage payment.

With a lower interest rate, you may save tens and thousands of dollars over the life of the loan so be sure to check your credit report and scores with Equifax, Experian, and TransUnion. If there are any errors, get those resolved before applying for a home loan. If your score isn’t where it should be – ideally 750+ but at least 700, you may want to wait and work on improving it before moving forward.

Consider the Total Housing Costs

source:lifeenrichmentrealty.com

When thinking about how much you can afford to pay each month on your home, remember to include more than your mortgage payment. Housing costs include that as well as your homeowners’ insurance, taxes, maintenance and repairs, and utility bills.

When comparing homes of similar sizes and prices in the same region, energy costs can vary significantly depending on the age of the house, the size of the lot and the rates of local utility providers. To avoid an unexpected financial hit ask about the average cost of those bills when house hunting. While an estimate may be included in the real estate listing, it’s always a good idea to look at copies of recent statements to see the actual numbers.

Find Advice You Can Trust

source:urban.org

Purchasing your first home is not the same as buying a brand new TV. There are several steps to consider from securing a mortgage to saving up for a down payment. This is why you need to find a trusted financial advisor or planner to recommend an appropriate home for you.

Once you begin looking at properties, real estate agents and mortgage brokers most likely won’t remain objective if they think they are going to make a sale. They may show you the homes that are the maximum of what you can afford not thinking of other expenses in your life. Ensuring your security, financial advisors will set you down the right path, where you know you will be making all the correct decisions. They will give you comprehensive advice with your circumstances in mind.

Assisting you to settle your finances before purchasing your home, an advisor will help you balance what you want most for what you want at the moment. This allows you to recognize how buying a home can impact other priorities later on. For instance, taking on too much mortgage debt can make reaching future financial independence challenging. This is especially if things go wrong.

Study Trends of the Real Estate Market

source:urban.org

Taking into account the fluctuating prices of homes in your area is vital before following through on a purchase. Based on the supply and demand, knowing the trends provide insight into the state of the real estate market. When the economy is strong and unemployment is low, the number of people looking for houses multiplies.

Plus, if there is a shortage of available houses, prices tend to increase, which is known as a “seller’s market.” Certainly, however, it’s better to search for a home in an area where prices are reduced or in one where they are known to remain stable.